06th July 2023 Issue: 02/2023-24

Increased TCS rates to apply from 1st October, 2023

The Budget 2023-24 amended certain provisions related to the Tax Collection at Source [TCS] on payments under the Liberalized Remittance Scheme [LRS] and on purchase of overseas tour program packages. The said amendments pertained to the increase in the rate of TCS from 5% to 20% with effect from 01st July 2023. Further, by way of amendment in Foreign Exchange Management (Current Account Transaction) Rules vide an e-gazette notification dated 16th May 2023,

the government brought the expenses incurred by International Credit Card under the ambit of LRS.

Now, considering the widespread impact of the changes and the difficulties being faced in their implementation, the government has made the following decisions:

To give adequate time to Banks and Card networks to put in place requisite ITbased solutions, the government has decided to postpone the implementation of its 16th May 2023 e-gazette notification. This would mean that transactions through International Credit Cards while being overseas would not be counted as LRS and hence, would not be subject to TCS until further notification.

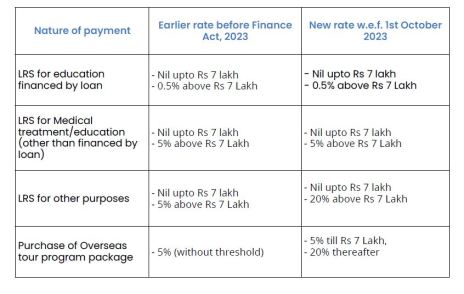

Threshold of ₹ 7 Lakh per financial year per individual in clause (i) of section 206C(1G) shall be restored for TCS on all categories of LRS payments, through all modes of payment, regardless of the purpose: Thus, for the first ₹ 7 Lakh

remittance under LRS there shall be no TCS. Beyond this ₹ 7 Lakh threshold, TCS shall be as follows:

A) 0.5% (if remittance is for education and is financed by an education loan);

B) 5% (if remittance is for education/medical treatment);

C) 20% for others

For the purchase of overseas tour program packages under Clause (ii) of section 206C(1G), the TCS shall continue to apply at the rate of 5% for the first ₹ 7 lakhs per individual per annum. Further, the 20% rate will only apply to expenditures above

this limit.

Increased TCS rates to apply from 1st October 2023:The increase in TCS rates which were to come into effect from 1st July 2023 shall now come into effect from 1st October 2023 with the modification as in (ii) above. Till 30th September 2023, earlier rates (prior to amendment by the Finance Act 2023) shall continue to apply.

Summary of Earlier and New TCS Rates: