Tax Advisory Services

Expert direct tax advisory for corporates, businesses, NRIs & global entities

SNR & Company offers end-to-end Tax Advisory Services, covering compliance, consulting, structuring, representation and global tax matters assisting organizations in India and Abroad with compliance, strategy, structuring and representation. With offices in Delhi, Pune and Bangalore, we support Domestic and International businesses with minimize tax exposure, reduce risks and improve tax efficiency with strategic planning and expert execution designed for efficiency, transparency and long-term savings.

Effective tax management is essential for every growing organization. With ever-changing tax laws, increasing compliance requirements and rising cross-border transactions, businesses need a trusted tax consulting partner who can help reduce risk, optimize tax structure and enhance financial outcomes.

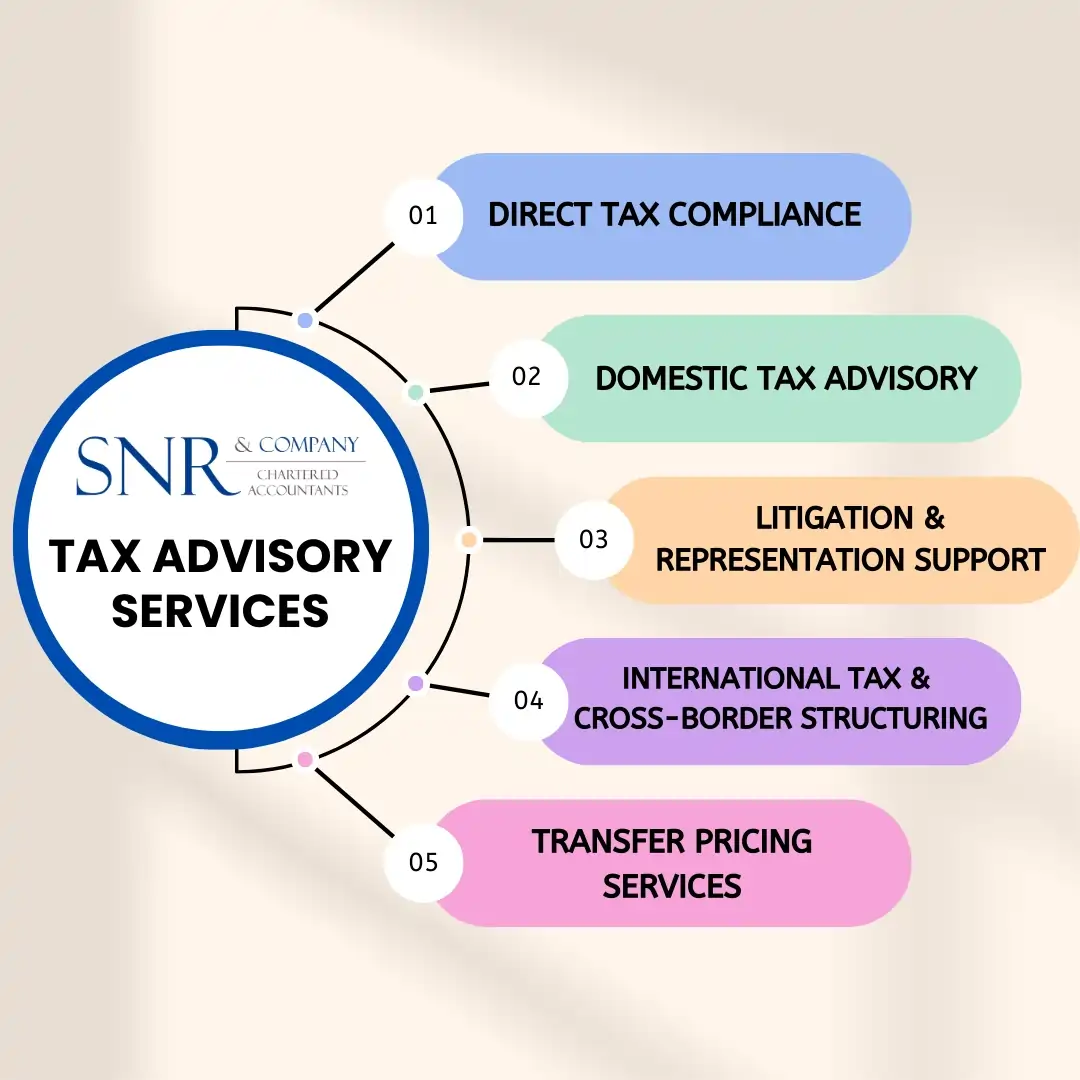

Our Tax Advisory & Consulting Expertise :

Direct Tax Compliance

- Corporate & non-corporate income tax return filing

- Withholding tax (TDS) return filings

- Annual declarations, forms, registrations & certifications

- Lower deduction certificates for resident & non-resident taxpayers

- Tax-exemption registration for NGOs

Domestic Tax Advisory

- Tailored tax planning strategies for businesses to reduce liability, manage exposure and strengthen financial efficiency.

- Our advisory approach focuses on enhancing tax savings while minimising litigation risk.

Litigation & Representation Support

- Representation before income tax authorities, tribunals & assessment bodies

- Drafting & defending matters from initial scrutiny to higher appellate levels

- Support during tax investigations, assessments, audits & queries

- We ensure uniform strategy, strong documentation and robust defence at every stage.

International Tax & Cross-Border Structuring

- Advisory for inbound and outbound investment structures

- Tax treaty implication guidance

- Expat payroll compliance & global tax reporting

- Double taxation avoidance and cross-border planning

Transfer Pricing Services

- Transfer pricing policy and documentation

- Country-by-country reporting & benchmarking

- Certification under Section 92E

- Advisory for inter-company international transactions

Why Businesses Choose SNR & Company for Tax Advisory Services

- 30 Years of Expertise in the Industry

- Trusted Tax Consulting Firm in India

- Strategic approach combining compliance + planning + representation

- Strong capability in international tax, NRI taxation & cross-border operations

- Focus on risk mitigation, tax efficiency & smooth execution

Whether you require tax planning, compliance support, structuring or representation, SNR & Company delivers reliable Tax Advisory & Consulting Services for businesses of every scale. Our goal is simple – Reduce stress for tax burden, strengthen compliance & drive better financial outcomes.

Your growth deserves precision – and we deliver it.

Looking for Tax Advisory Services?

Schedule a consultation and get expert tax guidance today.

Connect With Us

Any Queries ? Share your details and we’ll get back to you soon!